If you’re earning $45,000 a year and aspiring to achieve home affordability, you’re not alone. Many people, regardless of their income, share this aspiration. But the key question is, how much house can you afford on a $45,000 salary?

A general guideline is to spend no more than 3 times your annual income on a home. With a $45,000 annual income, you can afford a home priced around $135,000.

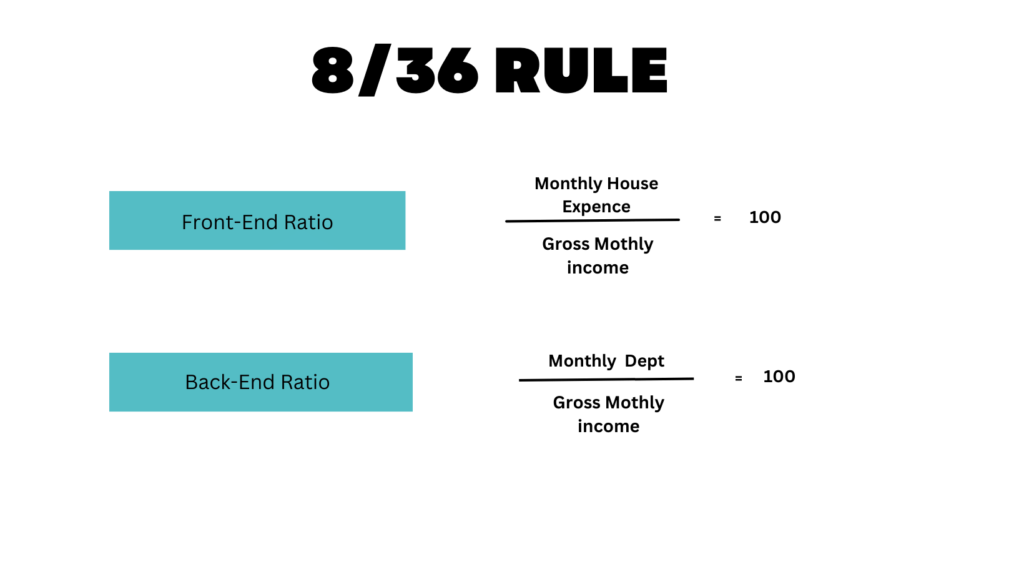

In this blog, we’ll explain the 28/36 and 50% Rules for budgeting and discuss front-end and back-end ratios for mortgage approval.

Let’s begin!

1. Mortgage Calculator

With just a few simple inputs, this powerful calculator will provide you with instant results, allowing you to visualize different scenarios, compare rates, and make informed decisions. Say goodbye to confusion and hello to clarity.

Related: if i make $90,000 a year how much house can i afford

2. Home Affordability on $45,000 Salary

To calculate your monthly budget, divide your $45,000 annual income by 12, giving you $3,750 per month. Stick to the 28% rule, which means your housing costs should not exceed $1,050 monthly. This amount should cover not only rent or mortgage but also other housing expenses.

Factor in existing debts like student loans and credit card payments as they impact your affordability.

3. Front-End Ratio

The front-end ratio is like a money puzzle. It helps you figure out how much house you can buy without going broke.

How to Calculate It

Add up all the money you spend on your house each month. That includes stuff like the mortgage, taxes, and insurance.

Now, look at how much money you make before taxes every month.

Divide the money you spend on your house by the money you make. That gives you the front-end ratio.

What’s a Good Ratio?

The smartest money people say your ratio should be less than 28%. So, if you make $45,000 a year (around $3,750 a month before taxes), you should spend no more than about $1,050 on your house each month.

4. Back-End Ratio

The Back-End Ratio, also called the debt-to-income ratio, helps figure out how much home you can buy based on your income. It compares all your monthly debts to your monthly income.

How to Calculate Your Back-End Ratio?

Add up all your monthly debts like credit card payments, student loans, car loans, and any other loans or bills.

Then, divide this total by how much you make in a month.

Multiply the answer by 100 to get a percentage.

What’s a Good Back-End Ratio?

Lenders usually want your back-end ratio to be 36% or less. This means that 36% or less of your monthly income should be used to pay debts.

If your ratio is higher, it can be tough to get a mortgage.

Different Lenders, Different Rules:

Remember, lenders, may have different rules for this ratio. Some may be flexible, while others are strict.

It’s a good idea to talk to several lenders and get pre-approved before looking for a house.

Improving Your Back-End Ratio:

If your ratio is too high, you can make it better.

Pay off some debts or find ways to make more money.

It’s Not the Whole Story:

The back-end ratio is just part of the picture. Other things like how much money you can put down upfront and the interest rates also affect how much house you can afford.

5. 8/36 Rule for Homeownership

When you want to know how much house you can buy with a yearly salary of $45,000, remember the 28/36 Rule. This rule says:

Don’t spend more than 28% of your monthly income on housing costs.

Your total monthly debt payments, including housing, shouldn’t be more than 36%.

By following this rule, you make sure you’re not spending too much on housing and have money left for other important things. To find the most you can spend on housing each month, do this:

If you earn $45,000 a year (which is $3,750 per month), multiply it by 0.28, and then divide by 12. For example:

$45,000 x 0.28 = $12,600 per year

$12,600 / 12 = $1,050 per month

So, if you make $45,000 per year, you should spend a maximum of $1,050 per month on housing. This includes your mortgage or rent, property taxes, and insurance.

Remember, these are just guidelines. Your situation might be different based on things like your credit score and existing debts. It’s smart to talk to a financial advisor or a mortgage expert to figure out what you can afford.

6. The 50% Rule in Real Estate

6. The 50% Rule in Real Estate

This rule helps you figure out how much house you can afford based on your salary. It says you shouldn’t spend more than half of your income on housing expenses. These expenses include your mortgage (the money you pay each month to own your house), property taxes (a tax for owning property), homeowners insurance (insurance to protect your home), and maintenance fees (money for fixing and taking care of your home).

Why Follow the Rule: By following this rule, you make sure you have enough money left over for other important things like electricity, food, getting around (like gas for your car or bus fare), and saving for the future. It’s a way to avoid spending so much on your house that you don’t have money left for everything else.

Important Note: The 50% Rule might not be right for everyone. If you owe a lot of money or have other important bills, it’s a good idea to spend less on your house so you can have more money to pay your debts or save.

Lenders Have Their Rules: When you want to borrow money from a bank to buy a house (a mortgage), they have their own rules. They look at how much you spend on housing and other debts. So, while the 50% Rule is a good starting point, it’s smart to talk to a bank or lender to see what they think you can afford based on their rules.

Every Person’s Money Situation is Different: What’s right for one person might not be right for another. So, take your time to think about your money and what’s most important to you before deciding to buy a house.

7. How to Improve Your Chances of Mortgage Approval

While your salary of $45,000 a year may limit the amount of house you can afford, there are steps you can take to improve your chances of mortgage approval. Here are a few tips:

1. Improve Your Credit Score: A higher credit score will make you more attractive to lenders and could result in lower interest rates on your mortgage.

2. Save for a Down Payment: The larger your down payment, the less you’ll need to borrow and the more affordable your monthly payments will be.

3. Reduce Debt: Lowering your debt-to-income ratio by paying off outstanding debts can increase your chances of getting approved for a mortgage.

4. Consider Government Programs: Investigate programs such as FHA loans or VA loans that offer favorable terms for first-time homebuyers or veterans.

5. Consult with a Mortgage Professional: Working with an experienced mortgage professional can help you navigate the process and find loan options that best suit your financial situation.

Remember, buying a home is not just about what you can afford today but also about considering future expenses and financial goals. It’s important to carefully evaluate all aspects before making any decisions regarding homeownership.

Frequently Asked Questions (FAQ) on Home Affordability with $45,000 Salary a year

1. How much house can I afford with a $45,000 salary?

Your house budget on a $45,000 salary should be around $1,050 per month, considering your debts and credit score.

2. What are the 28/36 and 50% Rules for budgeting?

28/36 Rule: Don’t spend more than 28% of your income on housing, and keep all your monthly debts under 36%.

50% Rule: Aim to use less than half of your income for housing expenses.

3.. How can I improve my chances of mortgage approval with a $45,000 salary?

To boost your chances of getting a mortgage:

Improve your credit score.

Save more for a bigger down payment.

Pay off your debts.

Check out special government programs for new homebuyers or veterans.

Talk to a mortgage expert for help.

4. i make $45,000 a year how much house can i afford reddit?

The general rule of thumb is that you can afford a house worth approximately 2.5 to 3 times your annual income, so with a $45,000 annual income, you might be able to afford a home in the range of $112,500 to $135,000. However, this can vary depending on your specific financial situation and local housing market conditions.

Read More: How much house can i afford with 100k salary

Read More: if i make $90,000 a year how much house can i afford

Read More: i make $85000 a year how much house can i afford

- Secret Websites to Make Money in 2025 - April 30, 2025

- Webull vs Robinhood: Which one is better in 2025? - February 14, 2024

- Bubble Cash Review For 2024: Is it Legit or a Scam? - December 30, 2023

6 thoughts on “i make $45,000 a year how much house can i afford”